BANK OF ALBANIA

PRESS RELEASE

Governor Sejko: Statement to the Press Conference on Monetary Policy Decision, 2 November 2022

Publication date: 02.11.2022

Dear Ladies and Gentlemen,

Today, on 2 November 2022, the Supervisory Council of the Bank of Albania reviewed and approved the Quarterly Monetary Policy Report.

The Report concludes the external supply shock is increasingly weighing on the Albanian economy.

In particular, the information analysed in this Report shows that inflationary pressures are hiking and their base is expanding. This assessment is based on the continuing presence of soaring prices in global markets, the relatively strong demand for goods and services in Albania, the increasing utilisation of production capacities, and on the expected higher inflation rate from the economic agents.

Against this backdrop, the Supervisory Council decided to continue the normalisation process of monetary policy stance. This normalisation is needed for controlling inflationary pressures and for inflation returning to target within 2024. Hence, the Bank of Albania will support the safeguarding of domestic monetary and financial stability and will establish the adequate conditions for the sustainable and long-term growth of the Albanian economy.

***

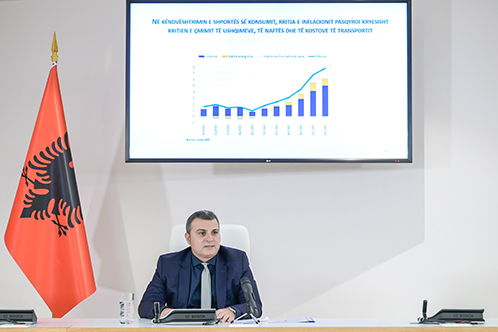

Consumer price inflation rose further in the third quarter, averaging 7.9% during the quarter, showing a progressive increase throughout this quarter.

In terms of consumer basket, the increased inflation reflected - at the highest degree - the upsurge in prices of food, oil and in transportation costs. These group-items generated around 80% of headline inflation in the third quarter. Nevertheless, the rise in prices has started to be present across most part of the basket, including those items whose most part of added value is created in Albania. This performance suggests the simultaneous increase in both inflationary pressures base and intensity.

In the macroeconomic view, the rise in inflation mostly reflects the strong pressures coming from the external environment coupled with an increasing contribution from the domestic environment. Three factors drove to the he build-up of domestic inflationary pressures. First, the good cyclical position of the Albanian economy – which derives from the stable demand for goods and services and implies a high utilisation of domestic production capacities - is accompanied by a rapid increase in wages. Second, high commodity, oil and energy prices, drive up the domestic production costs. Third, the upward expected inflation affects the rise in the prices of future covenants.

Despite these shocks, the Albanian economy has continued to grow during 2022. According to INSTAT data, the Albanian economy grew by 2.2% in the second quarter of 2022. Indirect data suggest economic growth has remained in positive territory in the third quarter as well, underpinned by the expansion in both private consumption and in the export of goods and services. This performance was reflected in the growth across the sectors of services, agriculture and in certain of branches of industry, as well as the in further rise of employment and wages in private sector. Wages in private sector marked an annual increase of 11.9% in the second quarter, reflecting both the solid labour demand and the continuous fall in unemployment rate.

A simulating financial environment - despite the reducing intensity of monetary stimulus - supported the expansion of the economic activity. Financial markets in Albania continue to be calm, with sufficient liquidity for meeting the economy needs, with still accommodative interest rates, coupled with a strong and stable exchange rate. This financial environment has enabled the maintaining of credit growth pace to private sector. In September 2022, credit portfolio to private sector recorded an annual growth of 13.9%, by covering the funding needs - both in lek and foreign currency - of the Albanian households and enterprises.

However, economic growth showed a slowing momentum after the first quarter. This slowdown reflects the negative effects triggered by the hike in inflation in Albania and worldwide. In addition, these effects are manifested in the form of increased uncertainty of enterprises, acute tightening of financial conditions, contracted purchasing power and a larger import bill for the Albanian economy.

Our baseline projections for the coming two years, forecasts the Albanian economy will continue to grow while inflationary pressures will lower.

Inflation is expected to remain high in the fourth quarter of the current year, but progressively reduce during 2023, and return to the target in the second quarter of 2024. The ongoing normalisation process of monetary policy stance conditions this projection. In addition, it factorises our expectations for stabilised prices in international markets and further expansion of economic activity in Albania.

Economic growth in Albania is expected to remain in positive territory, though the growth pace will slow down the short run, to turn accelerating in the medium term. The sound balance sheets of households and enterprises, the further expanded Albanian exports and the decreased uncertainty in response to the expected reduced inflation will continue to fuel the economic growth. Also, a stable monetary and financial environment will continue to feed through the expansion of economic activity. In particular, the sound and liquid balance sheets of the banking sector guarantee that the latter will continue to fund the Albanian households and enterprises, in turn supporting the expansion in consumption and meeting the temporary needs for liquidity.

Nevertheless, the Bank of Albania points out that the overall environment remains challenging and heightened uncertainties surrounding projections. These uncertainties on inflation remain tilted on the upside, while on economic growth on the downside.

***

Judging on the above, the Supervisory Council re-affirmed its assessment that the elevated inflationary pressures are the primary risk to a stable long-term growth of the Albanian economy.

As such, and in full concordance with safeguarding our price stability objective, the Supervisory Council decided to:

- Increase the policy rate by 0.5 percentage points to 2.75%, from 2.25%;

- Increase the overnight lending rate by 0.5 percentage points to 3.75%, from 3.25%; and

- Increase the overnight deposit rate by 0.5 percentage points to 1.75%, from 1.25%.

In the Supervisory Council’s judgement, the monetary policy normalisation, from its still simulating position to the current neutral one, is indispensable to safeguard our price inflation target. In this view, this normalisation paves the path for the overall economic and financial stability of Albania, the sustained and long-term economic growth and the improved social welfare.

In consistence with our previous communications and with our medium-term forecast, the Supervisory Council highlights that the monetary policy normalisation cycle will continue over the coming quarters. The normalisation speed, in any case, will be data-dependent and sufficient to safeguard our medium-term inflation target.

The Supervisory Council will carefully monitor the situation to assess in a timely manner the implications to inflation performance and identify the necessary measures in a timely manner for its effective management.

Twitter

Twitter

Youtube

Youtube

Facebook

Facebook

Flickr

Flickr

RSS

RSS

Subscribe

Subscribe

Feedback

Feedback