BANK OF ALBANIA

PRESS RELEASE

Article by Governor Sejko for Monitor Magazine

Publication date: 27.02.2024

Exchange rate performance, reasons and its economic consequences

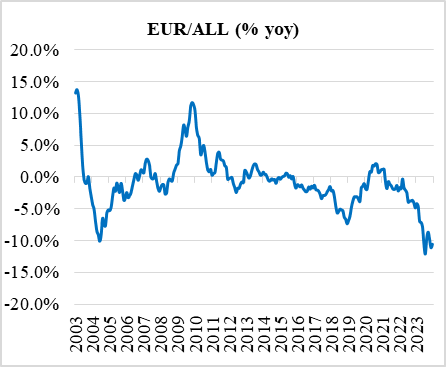

The performance of the exchange rate, for anyone who has been following the economic developments in Albania, even for those indirectly interested, has been and remains one of the most discussed topics of 2023. Our national currency, the lek, has exhibited a significant increase in its value against the euro and other currencies. The ALL/EUR exchange rate averaged 108.7 in 2023, from the average ALL/EUR 119.0 in 2022. This performance implies an annual strengthening of the lek of 8.7%.

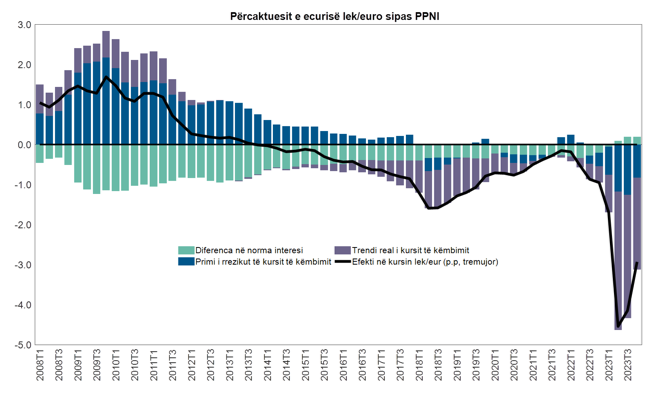

Chart 1 Performance of ALL/EUR exchange rate, at level (left) and as an annual change (in %, right)

|

|

|

Source: Bank of Albania.

The economic analysts and interest groups have broadly discussed the reasons and consequences of this phenomenon. Overall, the professional discussion focuses on two main topics. First, whether the strengthening of the exchange rate is based on real and structural improvements of our economy, or it is explained by other reasons, where the presence of high informal EUR inflows is suggested as the primary hypothesis. Second, if this development should be considered a movement towards a new and more appropriate equilibrium in macroeconomic perspective, or is it in fact a harmful development for the Albanian economy and financial markets.

The following article aims to present - once again and in a summarised manner - the viewpoint of the Bank of Albania on these issues.

On the reasons behind lek exchange rate strengthening

The dynamics of the exchange rate - in a free-floating exchange rate regime - as operated in Albania, is a function of the demand and supply ratio for foreign currency. This ratio, in absence of interventions by public authorities, is determined by market forces and accommodates the country's economic and financial trends. The strengthening of lek exchange rate over the course of 2023, as considered in this context, suggests that there is a surplus in foreign currency supply in the domestic foreign exchange market. The analysis of the available information shows that the robust and continuous improvement in the balance of trade and financial exchanges with abroad in the last two years triggered this surplus.

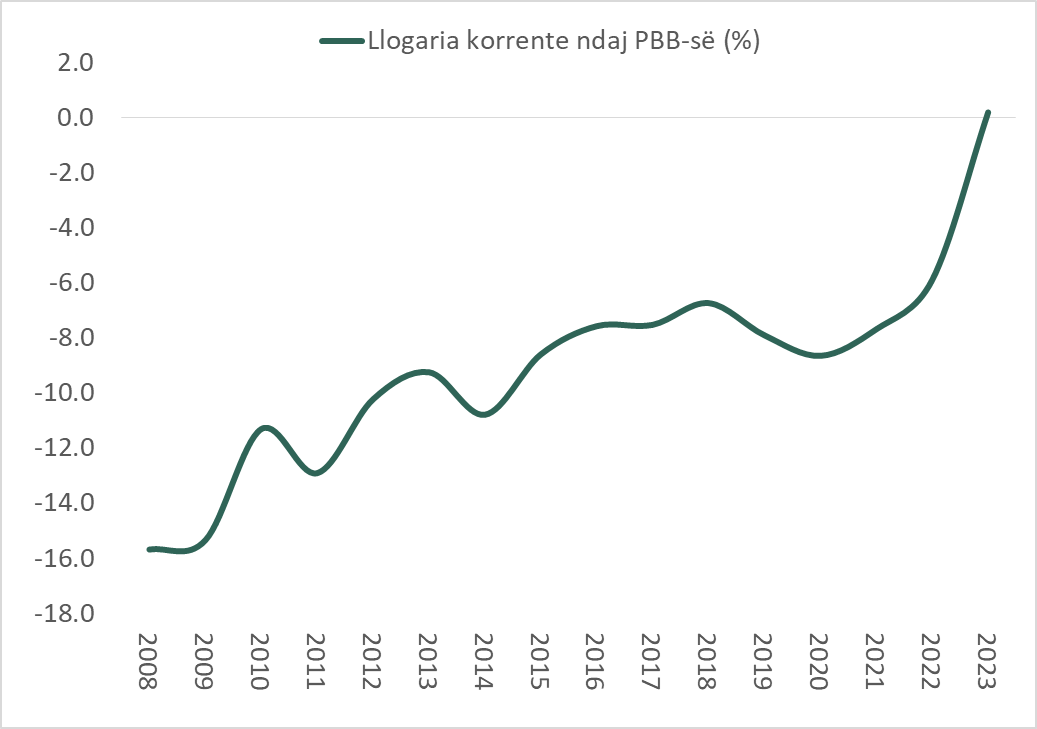

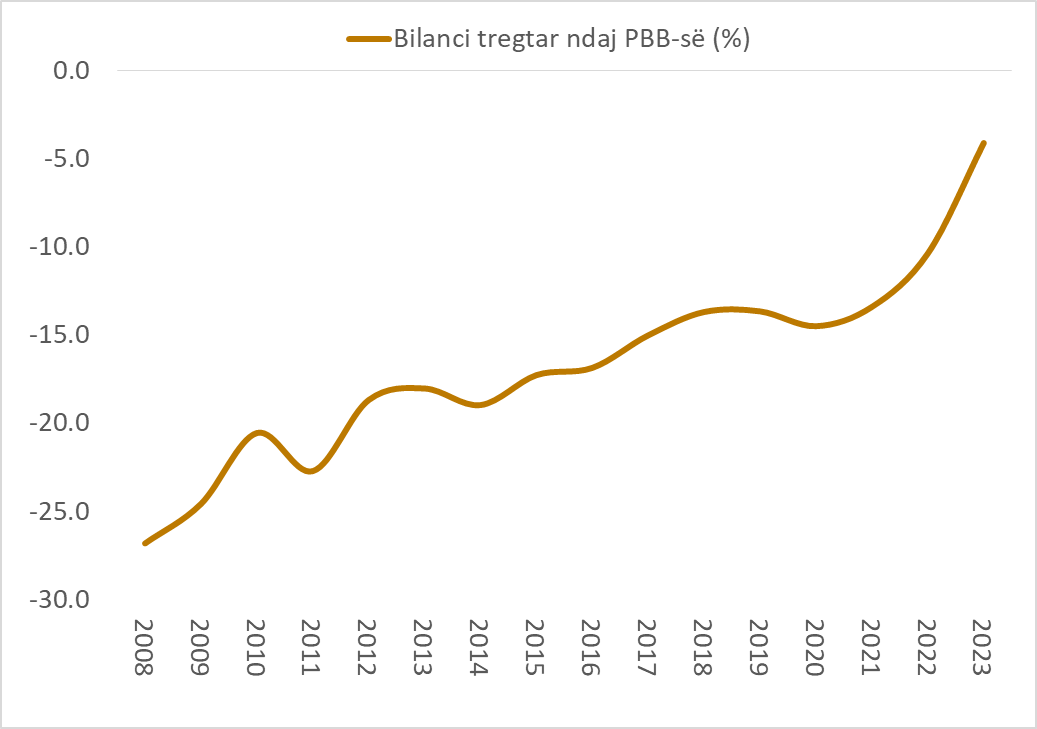

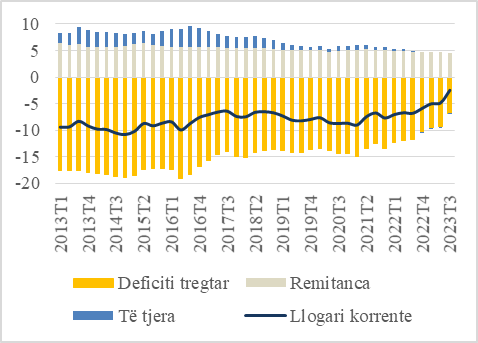

From a general perspective, the surplus of foreign currency supply in the domestic market (Charts 2 and 3) is induced by the rapid decline in the trade and current account deficits over the last years (Chart 2), and the improvement in its financing ratio with foreign direct investments (Chart 3). In the first 9 months of 2023, the current account resulted in a surplus for the first time in history (Chart 2, left panel). The current surplus ratio to GDP is assessed at 0.2%, while the current deficit accounted for 4.7% of GDP in the same period of the previous year. This development represents a swift and unprecedented improvement in the external balance of the Albanian economy, bolstered by the structural improvement of the balance of trade exchanges in goods and services (Chart 2, right panel).

Chart 2 Annual performance of current account balance and trade balance (in % of GDP)

|

|

|

|

Source: Bank of Albania.

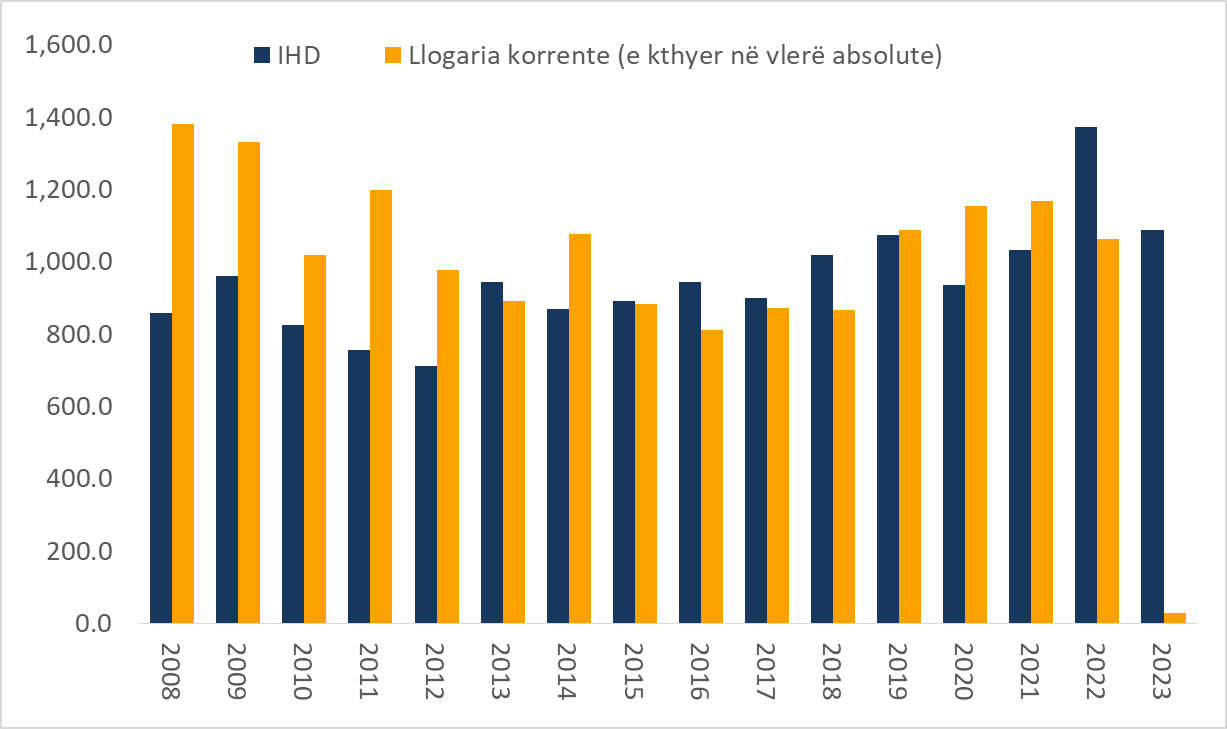

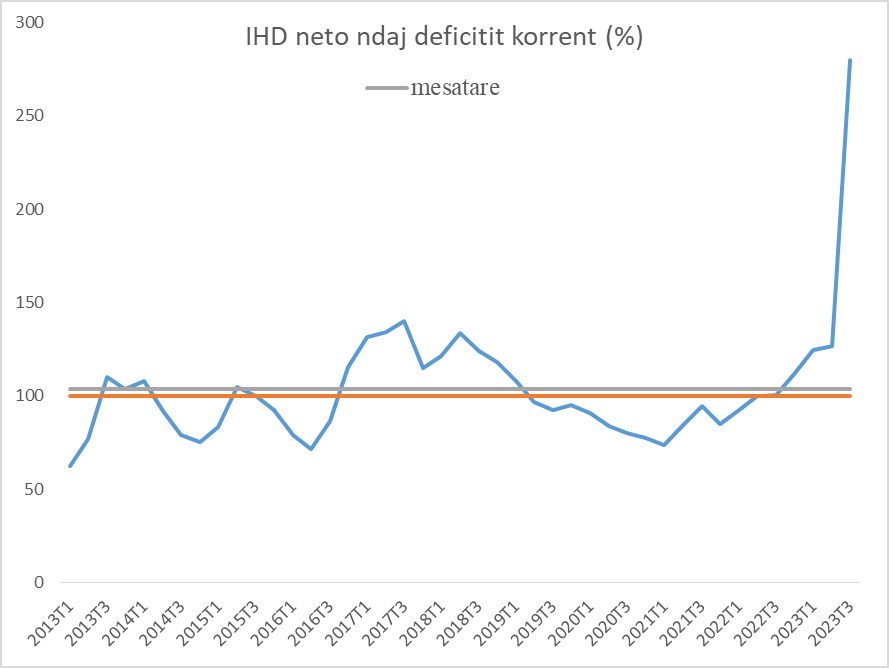

Foreign Direct Investments (FDIs), in parallel with the improvement of the trade balance and the current account balance, have notably trended up over the last years. Consequently, their ratio to current account deficit has been continuously edging up (Chart 3, left panel). The positive value of this ratio indicates that foreign currency flows generated by foreign direct investments (foreign currency inflows) are higher than the current account deficit (foreign currency outflows). This dynamic results in a supply surplus in the domestic market and in an appreciation of the exchange rate. Also, this chart suggests two preliminary conclusions: (i) Albania has historically had a surplus of foreign currency inflows, which in turn dictates a gradual trend of the exchange rate strengthening, and (ii) the moments of rapid growth of this ratio (the period 2017 - 2018 and 2022 - 2023) coincide with the periods of rapid strengthening of the lek exchange rate against the euro.

Chart 3 Current account deficit and net FDIs (left, in EUR mln) and their ratio (right, in %)

|

|

|

Note: The data, for each indicator, is constructed as a moving average of the last four quarters.

Source: Bank of Albania.

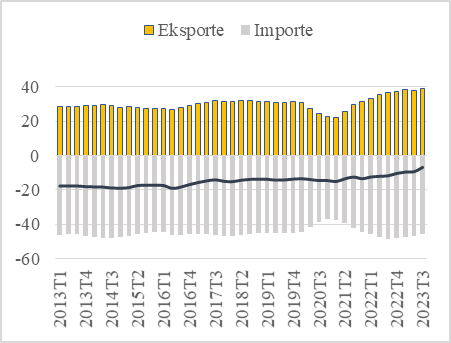

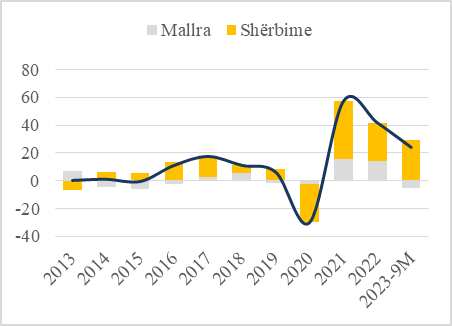

In a more detailed view, the pronounced improving trend of the current account deficit over the last years marks an important structural improvement of the Albanian economy. This deficit has declined from 10 % average of GDP in the first half of the last decade, to an around average of 3.5% in recent years (Chart 4, left panel). In addition, this structural improvement has reflected the reduced net export deficit. This journey has driven deficit to come down, from an average of around 20% of GDP in the first half of the last decade, to lower than 4.5% of GDP in the first nine months of 2023.

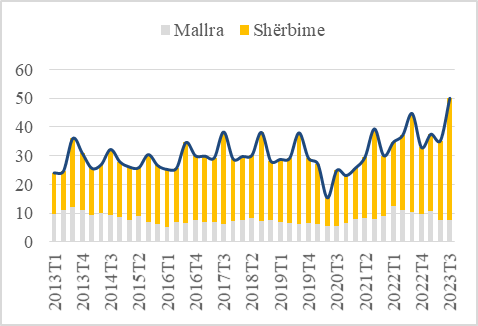

The deficit in net exports reduced during this period as exports in goods and services increased (Chart 4, right panel). Albanian exports grew from an average of around 28% of GDP, in the first half of last decade, to 39% of GDP over the last two years.

Chart 4 Determinant factors of current account (right, in % of GDP) and trade deficit (left, in % of GDP)

|

|

|

Note: The data, for each indicator, is constructed as a moving average of the last four quarters.

Source: Bank of Albania.

Ultimately, the reduction in both the trade deficit and the account deficit, the increase in the surplus of foreign currency in the market and the strengthening of the exchange rate, were driven by the upward trend of the Albanian exports and their dynamics at that time. This trend started to appear during the period 2016 – 2018; it was interrupted by the shocks from the earthquake and the pandemic; while re-appearing stronger in the last two years. Chart 5 illustrates this dynamic: the left panel reflects the performance of exports to GDP; and the right panel their annual changes. Both indicators suggest a rapid growth in total exports of goods and services over the course of the last two years. Also, Chart 5 implies that the growth in exports was led, to a larger extent, by the boost in the export of services - with tourism peaking - and less by the increase in the exports of goods.

Chart 5 Exports as a ratio of GDP (left, in %) and as an annual change (right, in %)

|

|

|

Source: Bank of Albania.

Focusing on 2023, the reasons behind the rapid exchange rate strengthening rely on the stronger than expected improvement balance of trade and financial exchanges with abroad of Albania. In this regard, we note the following:

- The current account recorded a surplus, for the first time in post-transition economic history. This surplus, assessed at 0.2% of GDP for the first 9 months of 2023, exhibits a notable improvement against the 5.9% deficit of GDP recorded in 2022. The deficit improved mainly on the back of the elevated growth of tourism inflows in Albania. Income from tourism, for the first 9 months of the year, brought to the Albanian economy EUR 3.2 billion, marking an annual growth of 46.6%. The increase in remittances, amounting around EUR 676 million in the first 9 months, with annual growth of 14.2%, provided further positive impacts in this regard.

- Foreign direct investments remained at high levels, estimated at around EUR 1.08 billion in the first 9 months, recording an annual growth of 10.6%.

This analysis supports the view expressed by the Bank of Albania that the strengthening of the exchange rate stems from the improvement in the balance of trade and financial exchanges with abroad, which has resulted in an increased foreign currency supply in the domestic foreign exchange market.

This view, however, is supported by two other considerations.

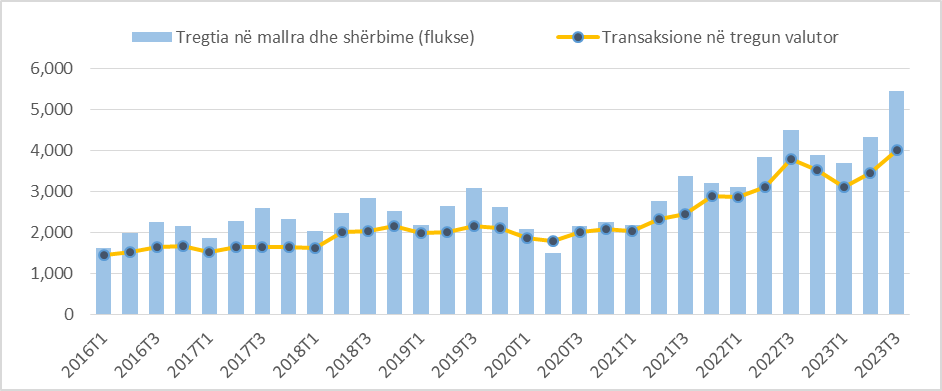

First, out econometric analyses, based on the uncovered interest rate parity model (UIRP), as an integral part of our analysis and forecasting model, suggest that the strengthening of lek exchange rate against the euro was driven, to a larger extent, by the strengthening of the real exchange rate, as shown in Chart 5. The strengthening trend of the real exchange rate is a well-known phenomenon for emerging countries, like Albania, at an onset of a convergence with large and more advanced trading partners, such as the European Union. In theory, the strengthening of the real exchange rate suggests a convergence trend of wages and prices between the Albanian economy and the euro area economy. This is a welcomed progress, as long as it relies on enhanced productivity in the economy and does not signal an overall decline in the competitiveness of the Albanian economy. In this context, it is worth highlighting that the increasing trend of exports, supported by the growth of tourism as a result of higher demand in this sector, represents an upward trend of productivity in the economy, as long as the tourism sector offers added value and higher wages compared to the average wage in the Albanian economy.

Chart 5 The impact of real and financial factors on the performance of ALL/EUR exchange rate

Source: Bank of Albania.

The strengthened confidence in our domestic currency has acted in the same direction as the real exchange rate, shown in Chart 5, by the reduced risk premiums, which in turn enable the economic operators to keep their savings in our domestic currency. On the other hand, the ALL/EUR interest rate gap, which also reflects the monetary policies implemented by the Bank of Albania and the European Central Bank, respectively, has a negligible effect, even of the opposite side, on the strengthening of the lek.

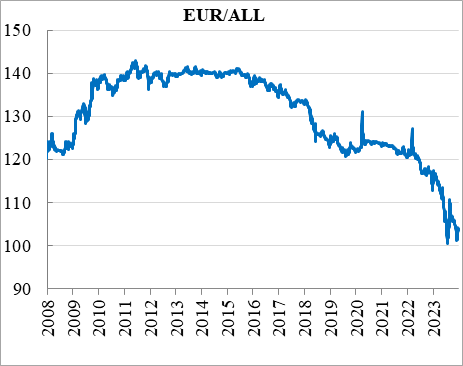

Second, the analysis on the foreign exchange market activity data for 2023 does not provide indicators of any deviations from normality in regard to how this market operates. Overall, the transaction volumes in the domestic foreign exchange market are in line with the volume of foreign trade in goods and services. This conclusion, as shown in Chart 6, stands true for both, the direction of movement of these two indicators, and for the fact that the volume of exchanges in the foreign exchange market has been and remains below the reported volume of foreign trade in goods and services. In this light, our analyses do not identify other sources that have materially impacted the performance of domestic foreign exchange market, apart from those of international trade.

Chart 6 The volume of exchanges in the domestic foreign exchange market (the volume of transactions between banks and foreign exchange bureaus with their clients, in EUR million)

Source: Bank of Albania.

Third, the high level of euroization of the economy has not dictated the strengthening of the exchange rate. On the one hand, it is fitting to emphasize that, in the face of an increased supply of foreign currency in the Albanian economy, a more aggressive policy towards discouraging the use of the euro in favour of lek would result in a faster strengthening of the exchange rate, and not the other way around.

***

On the economic consequences and the response of the Bank of Albania in regard to the strengthening of the exchange rate over the course of 2023.

The above analysis suggests that the Albanian economy has experienced structural improvements in its external balance over the last two years. These improvements have driven the strengthening of the real and nominal exchange rates, towards a new equilibrium, more suitable for its fundamentals.

In the span of two years, the ALL/EUR exchange rate strengthened by 10.2% (2023 Q1- Q3 vs 2021 Q1-Q3), while the volume of Albanian total exports grew by 80% for the same period. Under these circumstances, the performance of the exchange rate should be seen as a reflection of the success we had in the growth of exports and not as a premise of their failure.

Based on these premises, the appreciation of the exchange rate has had an overall positive impact on the Albanian economy. This effect is materialized in the reduction of inflation, in the preservation of both purchasing power and the value of households’ savings, as well as in lower financing costs for the Albanian economy. Also, the exchange rate appreciation has helped the sustainability of financial stability, through the improvement of balance sheets of foreign currency borrowers and the positive effect on the level of non-performing loans.

The reaction of the Bank of Albania to developments in the exchange rate has been and will always remain oriented in relation to our price stability objective and consistent with the free-floating exchange rate regime applied in Albania.

In more concrete terms, the period of the exchange rate strengthening has coincided with an elevated level of inflation and a normalization phase the of monetary policy stance. Against these pressures, the strengthening trend of the real exchange rate can take two forms: either strengthening of the nominal exchange rate or faster increase of inflation in the country. In countries operating a free-floating exchange rate regime, the nominal strengthening of the national currency helps this adjustment process, enabling the economy to absorb the consequences of the real exchange rate strengthening without harming price stability. For these reasons, fluctuations in the exchange rate are considered a crucial instrument for the adopting mechanism of economies to new economic and financial situations, as posed by domestic or foreign factors. In these cases, the exchange rate plays the role of the automatic stabilizer of the economy, without the intervention of restrictive monetary and fiscal policies, which have negative consequences in other branches of the economy. In countries with a fixed exchange rate regime, monetary policy should take a more aggressive stance, through raising interest rates and damaging other sectors of the economy that are not export-oriented.

In closing, we conclude that the strengthening of the exchange rate - which has originated from an increase in foreign demand for Albanian services - has helped in curbing inflation and has enabled a more gradual normalization of our monetary policy stance. As a result, it has helped preserving the purchasing power of households and has kept the financing costs of businesses and households at low levels.

Linkedin

Linkedin

Twitter

Twitter

Youtube

Youtube

Facebook

Facebook

Flickr

Flickr

RSS

RSS

Subscribe

Subscribe

Feedback

Feedback